Exploratory Data Analysis and Hypothesis Testing - Loan Prediction

Problem Statement:

About Company

Dream Housing Finance company deals in all home loans. They have presence across all urban, semi urban and rural areas. Customer first apply for home loan after that company validates the customer eligibility for loan.

Problem

Company wants to automate the loan eligibility process (real time) based on customer detail provided while filling online application form. These details are Gender, Marital Status, Education, Number of Dependents, Income, Loan Amount, Credit History and others. To automate this process, they have given a problem to identify the customers segments, those are eligible for loan amount so that they can specifically target these customers.

Introduction

The objective of this project is to do “Exploratory Analysis” and “Hypothesis Testing” on the features of this dataset to find various insights as to how each feature affects the chances of getting a loan.

Dataset

The Loan Prediction dataset consists of 613 customer details and 13

features.

Variable

|

Description

|

Loan_ID

|

Unique Loan ID

|

Gender

|

Male/ Female

|

Married

|

Applicant married (Y/N)

|

Dependents

|

Number of dependents

|

Education

|

Applicant Education (Graduate/ Under

Graduate)

|

Self_Employed

|

Self employed (Y/N)

|

ApplicantIncome

|

Applicant income

|

CoapplicantIncome

|

Coapplicant income

|

LoanAmount

|

Loan amount in thousands

|

Loan_Amount_Term

|

Term of loan in months

|

Credit_History

|

credit history meets guidelines

|

Property_Area

|

Urban/ Semi Urban/ Rural

|

Loan_Status

|

Loan approved (Y/N) --> Target Variable

|

SECTION 1:

Exploratory Data Analysis

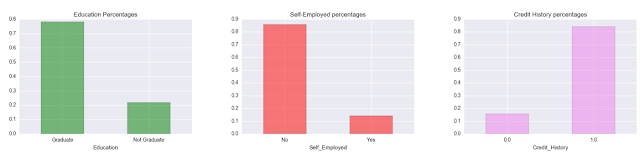

1.1 Univariate Analysis

Numerical Features:

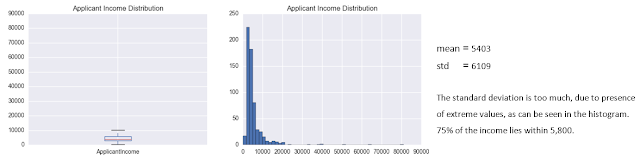

1. Applicant Income:

1.2 Bivariate and Multivariate Analysis

Categorical Features:

Categorical Features:

1. Property Area vs Loan Status:

“Question: is there an

association between getting a Loan and the Property Area?”

Since, P(A) != P(A/B), we can conclude that there is an

association between getting a loan and the property area. The probability of

getting a loan, regardless of property

area, is 68.7%.

However,

examination of a contingency table containing both Loan Status and Property

area showed that the conditional probability of getting a loan changes by

property area.

Visual

examination of the barplot shows the conditional probabilities of getting a loan

are not equal across Property areas.

2. Credit History vs Loan

Status:

“Question: is there an association between getting a Loan and Credit History?”

“Question: is there an association between getting a Loan and Credit History?”

Since, P(A) != P(A/B), there is an association between

getting a loan and the credit history. The probability of getting a loan,

regardless of credit history, is 68.7%.

However,

conditional probability showed that getting a loan changes by credit history.

From

the barplot, it is very clear that those customers who have a credit card

stands a better chance for getting a loan. We will do some statistical tests to

confirm this assumption

later on this project.

3. Education vs

Loan Status:

“Question: is there an association between getting a

Loan and Education?”

Since, P(A) != P(A/B), we can assume that there

is an association between getting a loan and the Education. Although, the

difference is just 9%, a statistical test would be helpful to confirm this assumption.

4. Loan Amount

Term vs Loan Status:

“Question: is there an association between getting a Loan and Loan Amount Term?”

“Question: is there an association between getting a Loan and Loan Amount Term?”

Since, P(A) != P(A/B), there seems to be an association. This needs to be confirmed

with some statistical tests.

NOTE: Loan Term was divided into 3 bins:

low[0-160 months], medium[160-320 months], high[320-500 months]

low[0-160 months], medium[160-320 months], high[320-500 months]

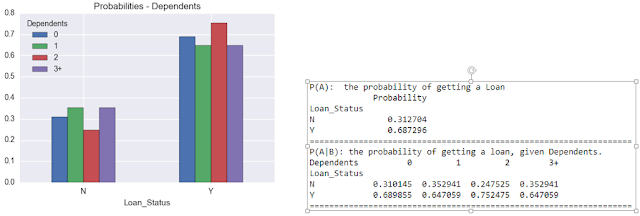

5. Dependents VS Loan Status:

“Question: is there an association between getting a Loan and Dependents?”

“Question: is there an association between getting a Loan and Dependents?”

For

Dependents == 0, P(A) = P(A/B), whereas, others seems to have an association.

6. Self Employed vs Loan Status:

“Question: is there an association between getting a Loan and Self Employment?”

“Question: is there an association between getting a Loan and Self Employment?”

Since P(A)

is almost equal to P(A/B). Our initial assumption would be that there is no

association between these two.

Need to

conduct a statistical test to confirm.

7. Gender vs Loan Status:

“Question: is there an association between getting a Loan and Gender?”

“Question: is there an association between getting a Loan and Gender?”

Since

P(A) and P(A/B) are almost equal, we would assume that there is no association

between these two. A statistical test would confirm our assumption.

8. Married vs Loan Status:

“Question: is there an association between getting a Loan and Married?”

“Question: is there an association between getting a Loan and Married?”

There

is a difference of around 9%, so we would assume that there is an association.

A statistical test would confirm their significance.

Numerical Features:

1. ApplicantIncome,

CoApplicantIncome vs LoanAmount:

“Question: Does

Loan Amount applied increases with increase in Applicant & Co-Applicant

Incomes?”

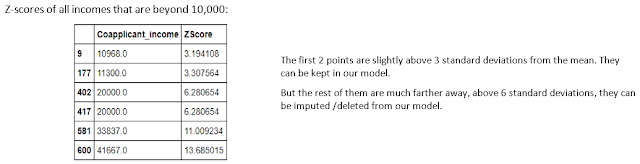

Correlation factor for ApplicantIncome and LoanAmount

accounts for 0.57, whereas for Co-applicant Income, it is very poor [just

0.18].

As we saw in Univariate analysis, there were few outliers, i.e.

observations having standard deviations higher than 3. Lets delete those and

recheck the correlation factors.

We

can only see a slight improvement for Co-applicant Income, increasing to 0.26,

whereas for ApplicantIncomes, it decreased by 0.05

Numerical

– Categorical Features:

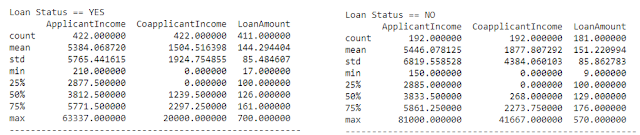

1. LoanAmount, ApplicantIncome,

Co-ApplicantIncome vs Loan Status:

By comparing both summaries, it is seen that there is no

enough evidence that getting a loan or not getting a loan is purely based on

Income Range or loan amount,as the means are almost same.

Although the standard deviations varies a lot, this is due to variation

in count.

We need to conduct some statistical tests to determine whether there is

actually any significance between the two groups.

2. Education VS Applicant Income:

“Question: Does Graduates have higher chances of getting a high Salary?”

By comparing both the groups, initial assumption would be that a graduate has more chances of getting a higher salary than a non-graduate.

SECTION 2:

Hypothesis Testing

1. Property Area

vs Loan Status:

As we saw in Bivariate Analysis that the conditional

probability of getting a loan is not equal across different property area.

So now we need to conduct a

statistical test to confirm this assumption.

Null hypothesis:

every property area has equal chances of getting a loan; [m1 == m2]

Alternate hypothesis :

not equal chances; [m1 != m2]

2. Credit History vs Loan Status:

As we saw in Bivariate Analysis that the conditional probability of getting a loan is not equal across different credit history.

Null hypothesis : equal chances of getting a loan for different credit history

Alternate hypothesis : not equal chances

3. Education vs Loan Status:

We

assumed that there is an association between getting a loan and Education, with

a difference of just 9% in conditional probabilities.

Null hypothesis : equal chances of getting a loan

for different education background

Alternate hypothesis : not equal

chances

4. Dependents vs

Loan Status:

Earlier

we found that except dependents = 0, others had an association with Loan

Status.

Null hypothesis : equal chances of getting a loan

for different no. of Dependents

Alternate hypothesis : not equal

chances

5. Loan Amount

Term vs

Loan Status:

Earlier

we divided the Loan Amount Term into 3 categories and through bivariate tests

we assumed that there is actually an association with getting a loan.

Lets confirm

that assumption.

Null

hypothesis : equal chances of getting a loan

for different Loan Term

Alternate hypothesis : not equal

chances

6. Self

Employed vs Loan Status:

Earlier

we assumed that there is no association between Self_Employed and Loan Status.

Null hypothesis : equal chances of getting a loan

for Self_employment

Alternate hypothesis : not equal

chances

7. Gender vs

Loan Status:

Null

hypothesis : equal chances of

getting a loan for Gender

Alternate

hypothesis : not equal chances

8. Married vs

Loan Status:

Earlier

we saw that probability of getting a loan for married people was high by around

9%.

Null

hypothesis : equal chances of

getting a loan for Married

Alternate

hypothesis : not equal chances

9. ApplicantIncome,

CoapplicantIncome, LoanAmount vs LoanStatus:

As we saw in bivariate analysis, there is no enough evidence that getting a loan or not getting a loan

is purely based on Income Range or loan amount, as the means are almost same. Lets conduct t-test taking

into account the incomes and loan amounts against loan status.

Null Hypothesis : customers with loan_status

== yes and those whose loan_status == no, have equal mean Applicant Income /Coapplicant

Income/LoanAmount

Alternate hypothesis : not equal mean

In

all the above cases, we fail to reject the null hypothesis as p-values >

0.05

Conclusion:

We did Exploratory data

Analysis on the features of this dataset and saw how each feature is

distributed. We also calculated probabilities to prove an association among the

Independent variables and the Target variable. And based on the results, we

assumed whether or not there is an association.

Lastly, Statistical Tests

were conducted so as to confirm or deny the assumptions we made.

Comments

Post a Comment